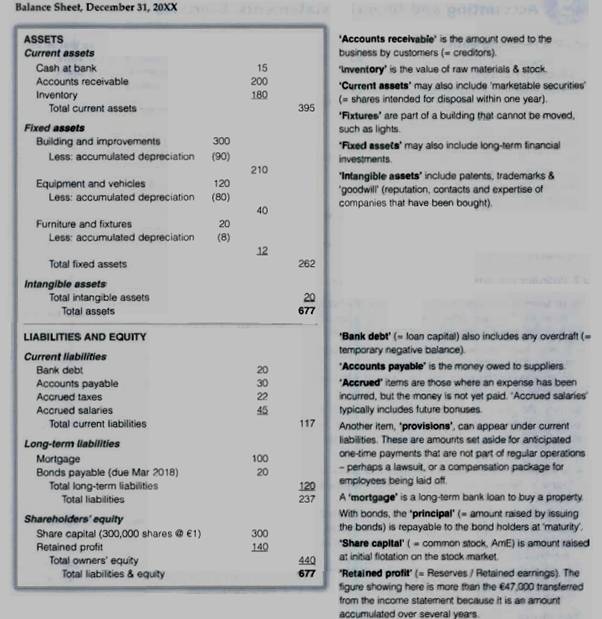

The balance sheet reports the company’s financial condition on a specific date. The basic equation that has to balance is:

Assets = Liabilities + Shareholders’ equity

An ’asset’ is anything of value owned by a business.

A ’liability’ is any amount owed to a creditor.

Shareholders’ equity (= owners’ equity) (BrE) / Stockholders’ equity (AmE) is what remains from the assets after all creditors have theoretically been paid. It is made up of two elements:

- share capital (representing the original investment in the business when shares were first issued)

- share premium (BrE) / paid-in surplus (AmE): money made if the company sells shares above their face value – the value written on them

- retained profit / eranings (= reserves) that has accumulated over time (have not been distributed to shareholders)

- reserves: funds set aside from share capital and earnings, retained for emergencies or other future needs.

- Assets are listed according to how easily they can be turned into cash, with ’current assets’ being more liquid than ’fixed assets’.

- Liabilities are listed according to how quickly creditors have to be paid, with ’current liabilities’ (= bank debt, money owed to suppliers, unpaid salaries and bills) being paid before long-term liabilities’.

- Figures for ’current assets’ and ’current liabilities’ are particularly important to a business. The amount by which the former exceeds the latter is called ’working capital’. This gives a quick measure of whether there is enough cash freely available to keep the business running.

Video 1: Balance sheet