Having decided on its strategy, a business needs to organize itself into a structure that best suits its objectives. This can be done in several ways.

- Organization by function: The company is divided into departments such as production, finance, marketing, human resources.

- Organization by product: The company brings together staff who are involved in the same product line (divisional)

- Organization by customer type: The company is organized around different sectors of the market. Large customers are called ’key accounts’.

- Organization by geographical area: The company is organized according to regions (divisional).

- In some companies – or for specific projects – there can be a matrix structure with cross-functional teams. Here employees from different parts of the organization work together and bureaucracy is reduced.

- Multi-dimensional matrix structure: may also be adopted. There is a combination of product and geographical divisions that allows a large company to adapt products for particular markets.

- Tall structure: complex hierarchies – many layers of management

- Flat structure: only a few levels of management

- The business must decide on the best way to organize its management hierarchy (═ chain of command).

- The company is run by top (═ senior) managers with job titles such as: Chief Executive Officer (CEO), Chief Operating Officer (COO), and a series of Vice-Presidents or Directors of different departments. Top managers set a direction for the organization and aim to inspire employees with their vision for the company’s future. This vision is often written down in a mission statement.

- The next level is middle management, where managers are in charge of (AmE head up) a department, division, branch, etc. Middle managers develop detailed plans and procedures based on the firm’s overall strategy.

- Finally, there is a supervisory (AmE first-line) management, and typical job titles are: Supervisor, Team Leader, Section Chief. Supervisory managers are responsible for assigning non-managerial employees to specific jobs and evaluating their performance. They have to implement plans developed higher up the hierarchy.

- Above everything there is the Board, chaired by a Chairman or President, which gets involved in ’big picture’ strategic planning and meets perhaps once a month.

- The CEO will be on the Board, but most Board members are not involved in running the company – they are elected by and responsible to the shareholders. Their main interest is shareholder value: getting a good return on investment in terms of both dividend payments and a rising share price.

Not all Boards are fully independent, but in general their role is to:

- Set long-term strategy

- Appoint a Chief Executive Officer (CEO) and other members of the senior management team to run the company day-to-day.

- Ask questions about any short-or medium-term strategy developed by the CEO, and then support it once they have agreed.

- Oversee the preparation of the financial statements.

- Appoint and ensure the independence of the company’s auditors.

- Oversee and manage risk.

- Set an annual dividend.

Who chooses the Board? In theory, it’s the shareholders. (in Germany: supervisory and management board)

At the Annual General Meeting (AmE Annual Meeting of Stockholders) the shareholders can

- question Board members (executive and non-executive directors)

- vote to accept or reject the dividend

- vote on replacements for retiring Board members, etc.

But, in practice, the situation may be different. In particular, most shares are held by large institutions, and these may simply sell their stake if they aren’t happy, instead of trying to change the Board. In reality, many Board members are chosen by the CEO and the shareholders simply approve these members. This whole issue of the role of the Board, how senior managers are responsible to shareholders, and how the company is run, is referred to as ’corporate governance’.

Traditionally, different regions of the world have had different models of corporate governance.

- Anglo-American model: separation of ownership (i.e. shareholders) and control (i.e. managers); priority given to the interests of shareholder.

- European / Japanese model: similar to the Anglo-American model, but a greater recognition of the interests of other stakeholders such as employees, suppliers, customers, leaders (e.g. banks), and the community.

- East Asian / Latin model: family-owned companies with no independent Board or outside shareholders.

Nowadays, this traditional pattern is breaking down, and the situation is more mixed. However, the following basic princples of corporate governance are widely accepted:

- Respect for the rights of shareholders

- A clear definition of the roles and responsibilities of Board members

- Integrity and ethical behaviour

- Disclosure (═ giving full information) and transparency.

- Centralization vs Decentralization

A key issue for the company is to decide on the degree of centralization. Should authority be kept at Head Office (centralization)? If so, this would mean:

- A strong corporate image

- Decisions made by experienced managers who see the whole picture, not just one part of the business.

- Standardized procedures which could lead to economies of scale (lower costs) and simpler distribution channels.

But decentralization also had advantages:

- Lower-level managers are more familiar with local conditions and can therefore give a stronger customer focus.

- The delegation of decision-making is likely to lead to a higher-level of morale at the grassroots.

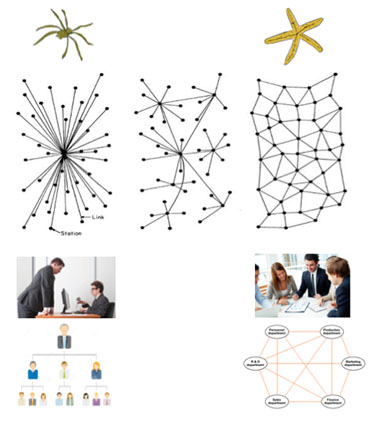

![]() Exercise 1: Try to compare the Spider and the Starfish organizational structure!

Exercise 1: Try to compare the Spider and the Starfish organizational structure!

![]() Exercise 2: There are many business idioms with animals. What do they mean? Use the text to understand them!

Exercise 2: There are many business idioms with animals. What do they mean? Use the text to understand them!

- Top dog

- Real dog

- Real dog

- Bear market

- Bull market

- Cash cow

- Eager beaver

- Lame duck

- Lion’s share

- Monkey business

- To flog a dead horse

- To be bullish

- To slave like a mule

- To go to the dogs

- To be a turkey

- To be a golden goose

- Unicorn

Video 1: Understanding A Company's Corporate Structure

Video 2: Fat CEO