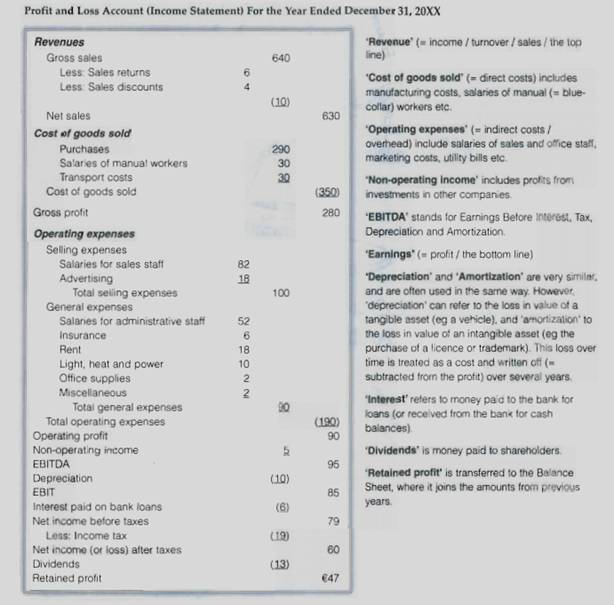

The profit and loss account (= income statement, or just ’the P&L’) summarizes business activity over a period of time. It begins with total sales (= revenue) generated during a month, quarter or year. Subsequent lines then deduct (= subtract) all of the costs related to producing that revenue.

- The terms ’direct costs’ and ’variable costs’ are close synonyms. They both refer to things, like raw materials costs and the wages of manual (= blue collar) workers. But:

- to emphasize costs which increase in proportion to any rise in output, say variable costs

- to empasize costs which can be identified with one particular product, say direct costs.

- Similarly, the terms ’fixed costs’, ’indirect costs’ and ’operating costs’ are close synonyms. They all refer to things like advertising, rent and the salaries. of office staff. But:

- to emphasize costs which stay the same at all levels of output in the short term, say fixed costs.

- to emphasize costs which result from the whole business (rent, utilities, etc.), not any particular products, say indirect costs. A synonym here is ’overhead’ (BrE overheads).

- to emphasize costs resulting from the day-to-day activities of the business (products and processes), say operating costs.

- There are many other types of ’costs’ referred to in finance and accounting. Two of the most important are:

- capital expenditure – the costs of buying or upgrading physical assets like buildings

- marginal costs – the costs of increasing output by one more unit.

British companies also have to produce a statement of total recognized gains and losses (STRGL), showing any gains and losses that are not included in the profit and loss account, such as the revaluation of fixed assets.