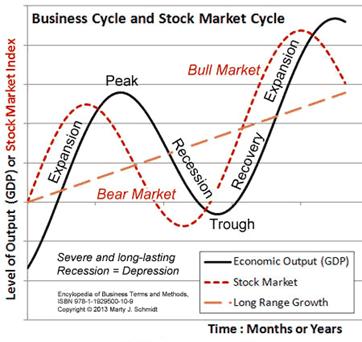

Business cycles are the shift between strong economic growth, described as a boom or expansion period, and periods of economic decline or stagnation. They are often referred to as cycles of boom and bust.

- As economies grow and businesses do well, workers are able to demand wage increases and buy more of the goods they produce. This fuels the economy’s boom. As more and more goods are sold, companies expand, hiring more workers to produce more goods. The new workers then have money to buy goods, and the boom continues.

- Competition means that all companies will increase production until supply outstrips demand.

- This forces companies to cut prices in order to attract customers, triggering falling profits, falling wages, and lay-offs among the workforce—in other words an economic crash followed by a recession.

- Companies begin to recover once prices become cheap enough to stimulate demand and credit becomes more available, starting the cycle all over again.

- As whole economies grow and contract, markets within them rise and fall. Markets that show sustained price rises are sometimes known as bull markets; those in which prices are falling as bear markets. These labels are usually applied to assets such as shares, bonds, or houses. Bull markets—for example, a rising stock market—often occur during periods of economic growth. Investors become more optimistic about economic prospects and buy shares in companies, so fuelling rising asset values.

- As the economy falters, the process goes into reverse. Investors become “bearish” and start to sell assets as the market falls. US stocks were in a bull market in the 1990s with the dot-com boom. A major bear market took place during the Great Depression of the 1930s.

- Skyscrapers are often built during times of excessive optimism, a sure sign that the economy is overheating. By the time they are finished, the economy has often crashed.

![]() Exercise 1: Number the order of events!

Exercise 1: Number the order of events!

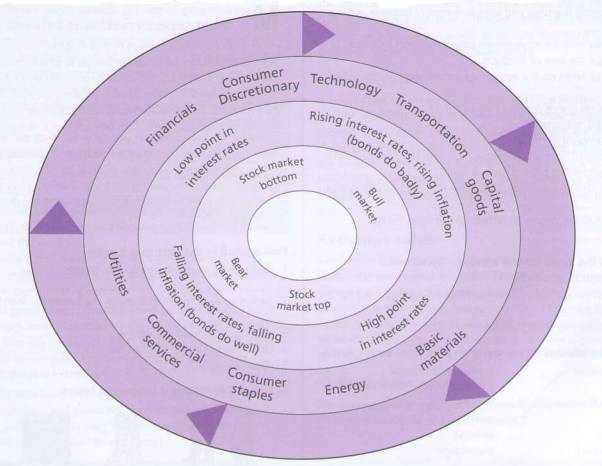

- Twelve o’clock marks the end of weakness in the economy and the early signs of growth. This was caused by the low interest rates bottomed out at around eleven o’clock.

a., Low interest rates mean cheap borrowing for individuals and companies. ___

b.,Amongst the quickest sectors to respond are consumer discretionary (e.g. restaurants, leisure, travel) and technology. ___

c., Once there are early signs of growth, transportation picks up (more goods are being shipped), and industry spends more on capital goods (e.g. machinery). ___

d., During this period, inflation starts to rise, and so bonds suffer. Bonds pay a fixed rate of interest to their bondholders, and the value of this interest is eroded over time as inflation goes up. ___

- All good things must come to an end. It’s six o’clock on the diagram.

e., By now, inflation has become a problem, and Central Banks have raised interest rates to deal with it. That means that credits are tight, and borrowing is expensive. The stock market recognizes that the end is coming, and peaks just before the final peak in the economy. ___

f., Investors now switch to more defensive stocks like consumer staples (e.g. food, household products) and utilities. ___

- Now it’s seven o’clock and we’ve entered the period of contraction. Stock markets are failing. But Central Banks see the danger and are lowering interest rates, to encourage spending and avoid a recession.

g., Bonds respond positively to the drop in rates, and they also benefit from a ’flight to safety’ effect as investors become cautious about stocks. ___

h., Eventually, financials start to recover as they anticipate more borrowing, and then the general stock market finds a bottom about six to nine months in advance of an upturn in the real economy. Just like at the top of the cycle, the market seems to know that a turn in the real economy is coming. ___

i., Now the economy is starting to show signs of strength and the whole cycle repeats again. ___